Xpel Is an Intriguing Play on the Auto Industry

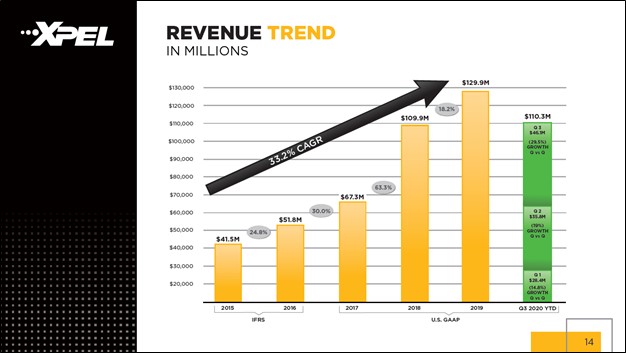

Xpel has a pristine balance sheet (nice net cash position), strong cash flow profile, ample growth opportunities, and a plan to boost its margins. The company primarily sells paint protection film products for automobiles, and its outlook appears quite promising as the firm is moving into adjacent areas while putting up rock-solid performance of late. We are highlighting Xpel given its potential for additional capital appreciation upside, though we caution shares of XPEL are up almost four-fold over the past year as of the middle of February 2021.

Xpel Chief Grows Protective-Film Maker By Focusing On Retailers

XPEL, 3M vs. Rayno - Which is the Best Paint Protection Film for 2024?

XPEL's Growth Potential And Competitive Landscape - A Hold

Why XPEL?, Discover The Difference

XPEL ULTIMATE PLUS PPF Protects Apex Autoworks Race Car at 101st

XPEL - Eloy Fernández Deep Research

Paint protection film sales mean big profits for service

2014 Review - Seattle Auto Detail, XPEL, Car Wraps & More

XPEL, 3M vs. Rayno - Which is the Best Paint Protection Film for 2024?

5 Reasons Why XPEL Paint Protection Film is Essential for Your Car

Xpel Is an Intriguing Play on the Auto Industry

Deep dive on XPEL ($XPEL) - by Jonah Lupton

Ben's Car Blog XPEL Ultimate - Long Term Review