Office Supplies vs. Office Expense vs. Office Equipment

Deducting office supplies for your home office: Budget friendly solutions - FasterCapital

Solved $ Cash Accounts receivable Office supplies Land

Advantage Office Products - Benbrook TX

Help entering business expenses

Equipment vs. Supplies: The Differences & Why They Matter

Office Supplies Vs Office Expense Ppt Powerpoint Presentation Gallery Brochure Cpb, Presentation Graphics, Presentation PowerPoint Example

Adrienne Austin Facebook, Instagram & Twitter on PeekYou

Tariqul Islam Tariq on LinkedIn: ইন্না লিল্লাহি

Marathon BE Can You Write Off Office Furniture as a Business Expense?

Answered: Office salaries, depreciation of office…

Adrienne Austin Facebook, Instagram & Twitter on PeekYou

What Happens if the Owner of a 529 Plan Dies?

Are Home Office Supplies Tax Deductible?

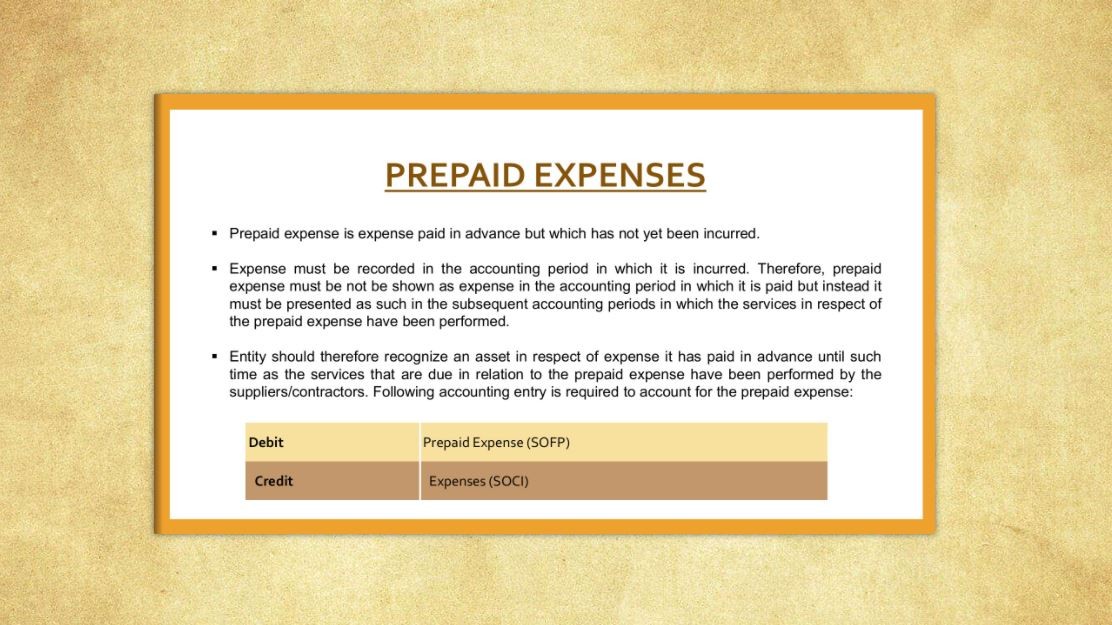

Prepaid Expenses Journal Entry, Examples

ASW Accounting - Check out this handy list of what you can (and cannot) write off regarding your home office expenses. For details on the 3 different methods to write off home