Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

See the methods and a step-by-step explanation of the five steps to claiming motor vehicle expenses from the CRA as a self-employed individual or an employee.

CRA says No Log Book, No Vehicle Expenses! - You've worked hard, now WORKWISE!

How to Track Mileage for Taxes in Canada?

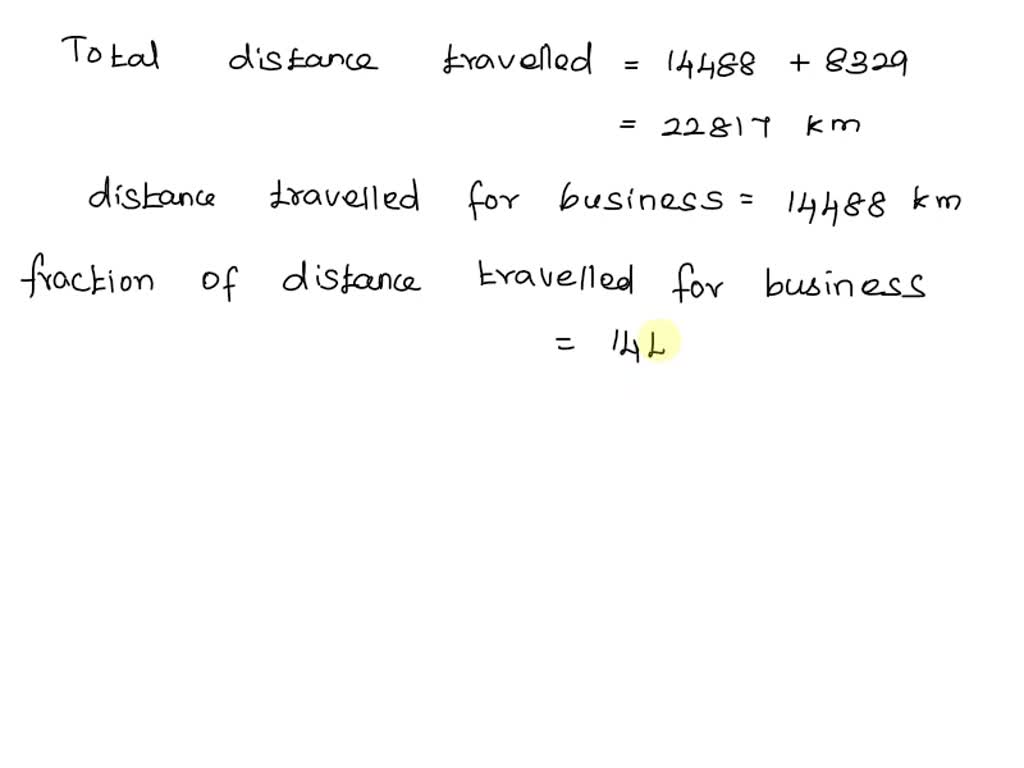

SOLVED: If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of the costs of operating the vehicle as a

DOs and DON'Ts of Claiming Car Expenses for Business Owners

How To Calculate Your Motor Vehicle Expenses For Taxes

CRA Mileage Allowances and Deductions Rules

Two ways to write off your vehicle expenses

What To Do After a Car Accident: Step-by-Step Guide

Canada Income Tax Forms

Tax Preparation Tip: Handling Work-Related Vehicle Expenses - FBC

How To Claim CRA-approved Mileage Deductions in Canada

How the CRA strike will affect your tax returns, refunds, benefits and more