How Markets May React To Fed's QT Program

The Great Steepening - Joseph Wang

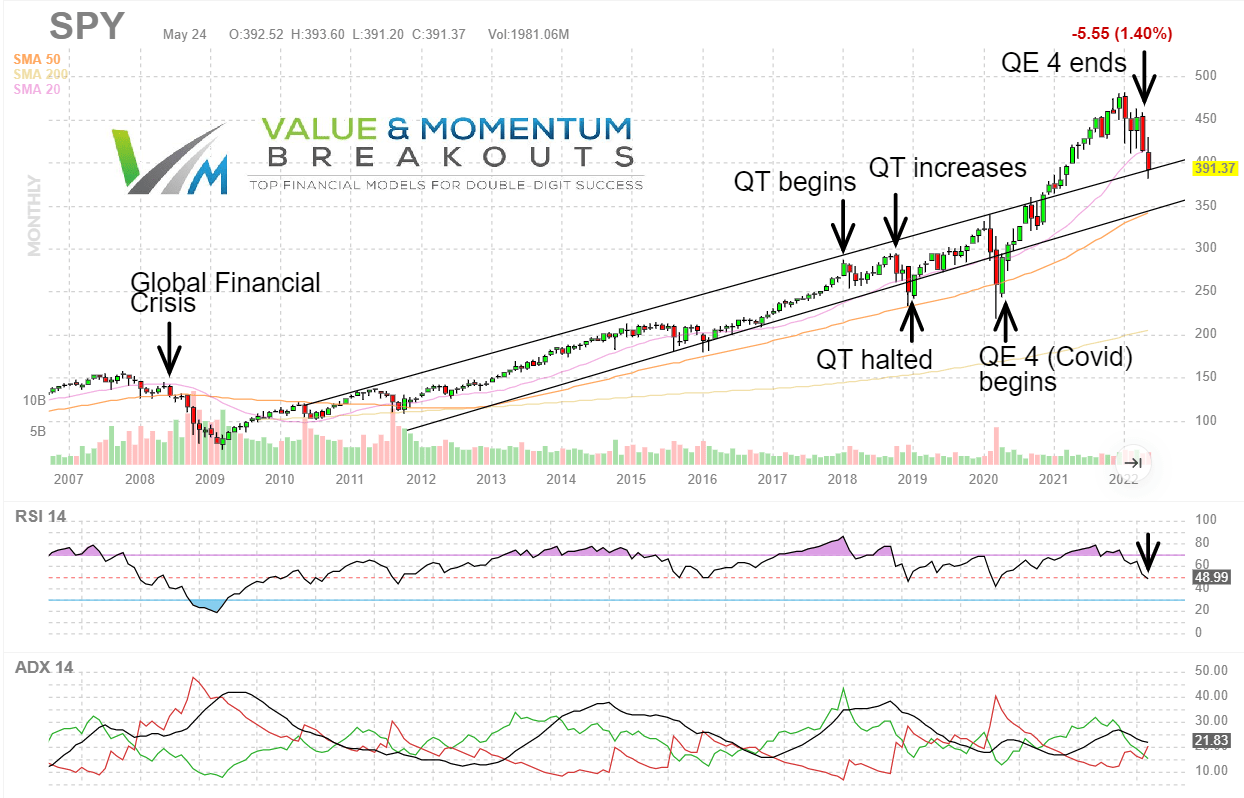

JD Henning, PhD, CFE, CAMS on X: $SPY #SPX long term chart of Fed QE / QT intervention with first QT since 2018 starting next week. Here are the market reactions to

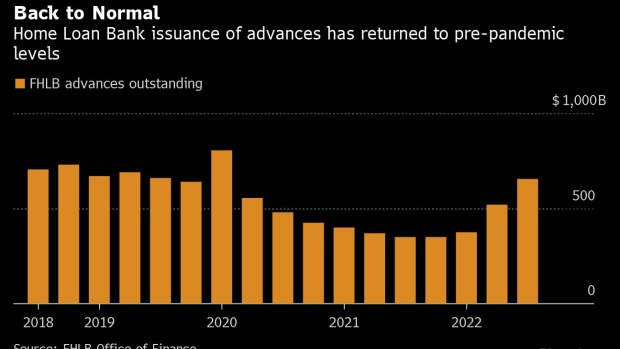

Banks Face Stiffer Competition for Funds as Fed QT Rolls On - BNN Bloomberg

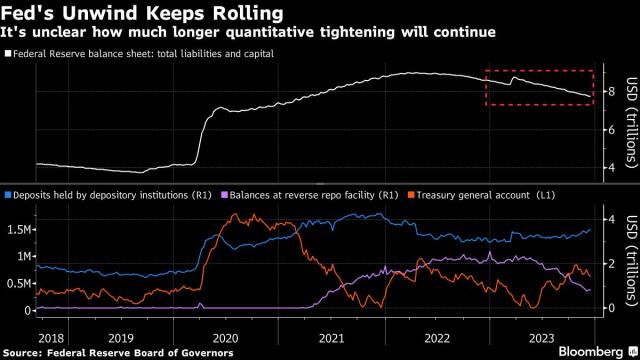

Markets See Fed's Exit From Quantitative Tightening Nearing

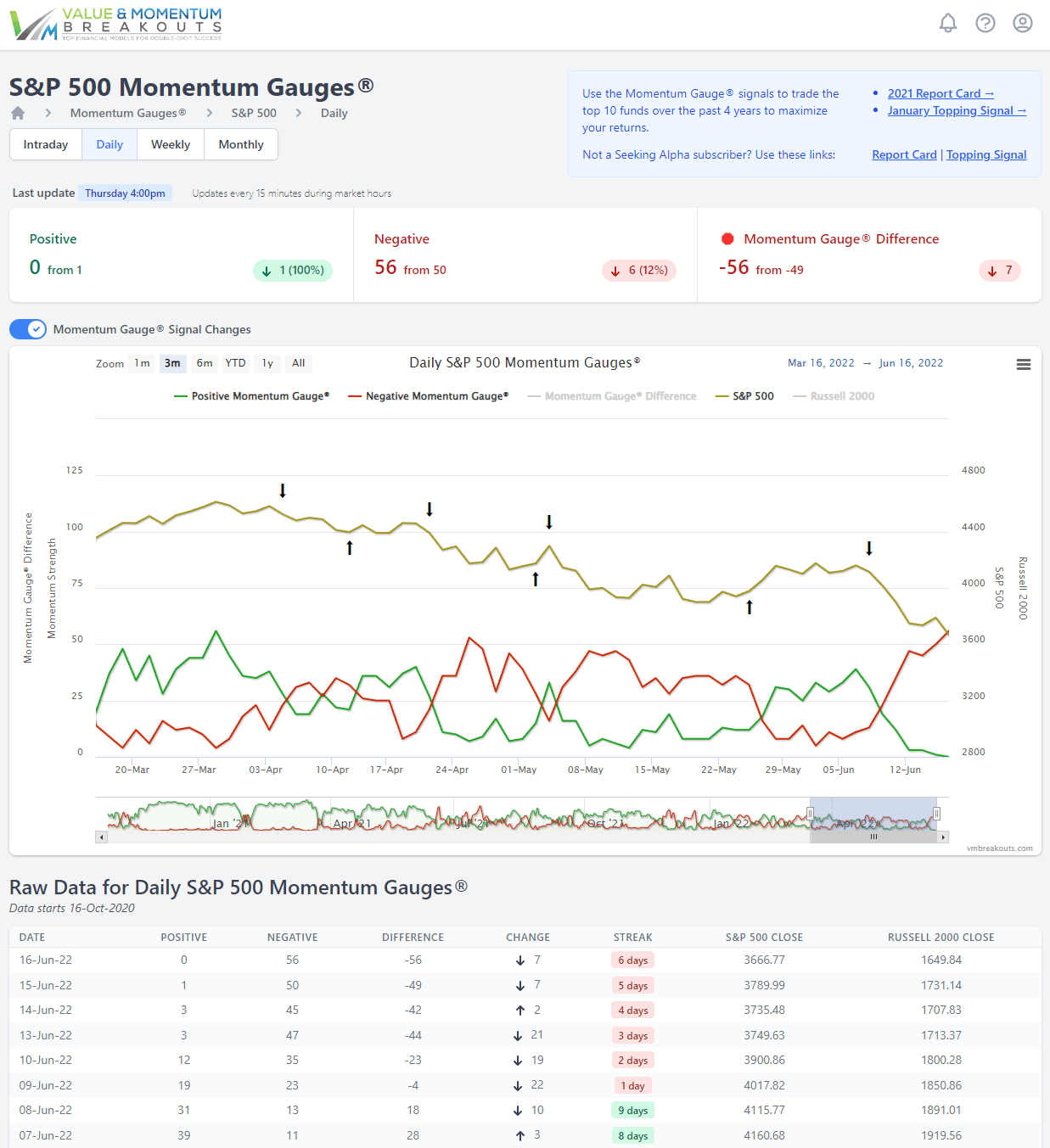

Momentum Gauge Topping Signal: 3rd Negative Signal In 2022

The Return of Quantitative Easing - Edward Conard

Fed's pivot raises investor question: When does QT start?

Quantitative easing lowered interest rates. Why isn't quantitative tightening lifting them more?

Quantitative Tightening: What is it and How Does it Work?

Fed Balance Sheet QT: -$91 Billion in July, -$759 Billion from Peak, Biggest Drop Ever, to $8.2 Trillion, Lowest since July 2021

The FED is continuing QT and reducing its balance sheet, however they also have agreed to backstop institutions affected by bank failures. This number is subject to change at any moment should

Finding Abnormal Returns With Russell Index's June Rebalancing

Momentum Gauge Topping Signal: 3rd Negative Signal In 2022

Fed's Balance Sheet Drops by $458 Billion from Peak: January Update on QT and the Fed's Losses

Finding Abnormal Returns With Russell Index's June Rebalancing