Tax Benefits for Child Daycare Providers and Users – Henssler Financial

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. We take a look at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

Tax Credit- Child Crisis Arizona- Qualifying Foster Care Organization

Dependents, Child Tax Credit, Additional Child Tax Credit, & Other

2023 Year-End Tax Planning Opportunities Are Here – Henssler Financial

Child Tax Credit info for foster parents – FPAWS

CHILDCTC - The Child Tax Credit

Child Care Relief Funding 2022 - Texas Workforce Commission

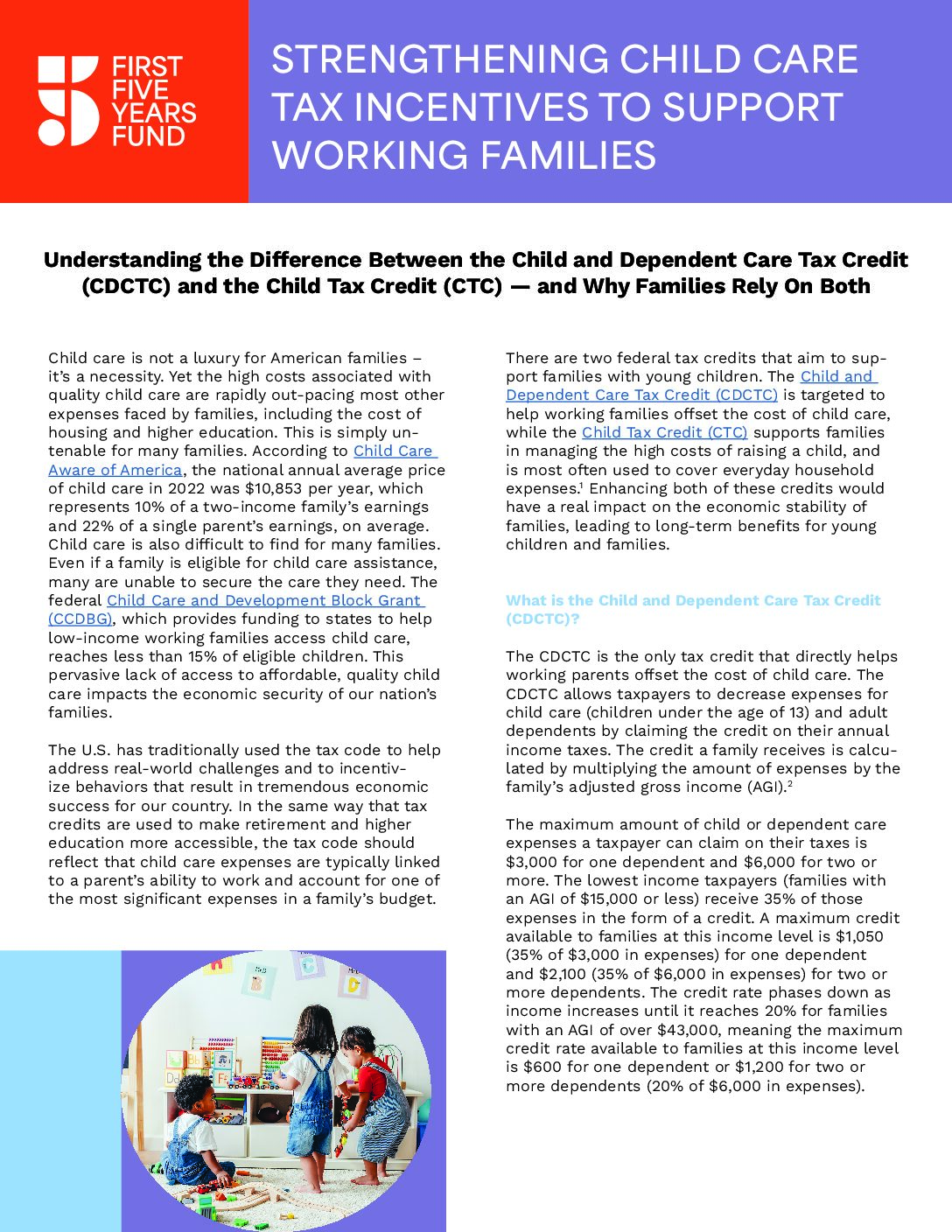

Understanding the Difference Between the Child Tax Credit and the

Tax Benefits for Child Daycare Providers and Users

Child Welfare

Child Tax Credit Definition, Eligibility, Calculation, and Impact

Five Reasons the Child Tax Credit Shouldn't Have a Work